The good, the bad, and the ugly of MEV.

Overview#

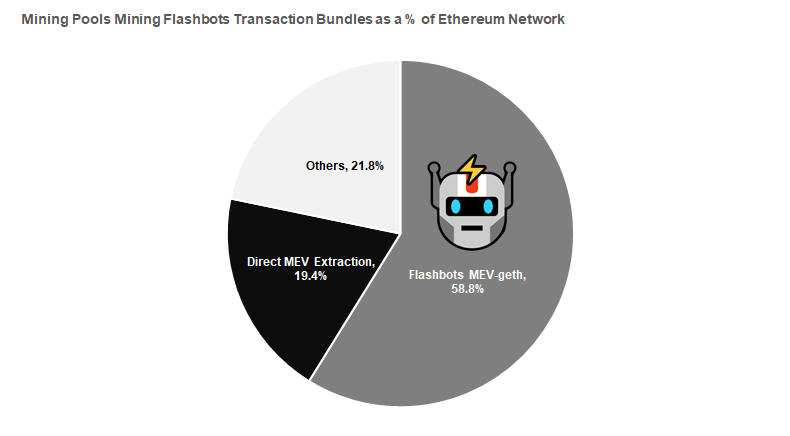

March 2021 has been the month of adoption and alignment for Flashbots. While one of the largest ethereum mining pools announced it directly extracts MEV by running its own sandwich bots but got rekt’d by a naughty salmonella upon launch, most miners have chosen a different path — to participate in a fair, and efficient sealed-bid MEV auction via flashbots alpha. At the time of writing, 12 mining pools accounting for over 58% of ethereum network hashrate are mining on flashbots.

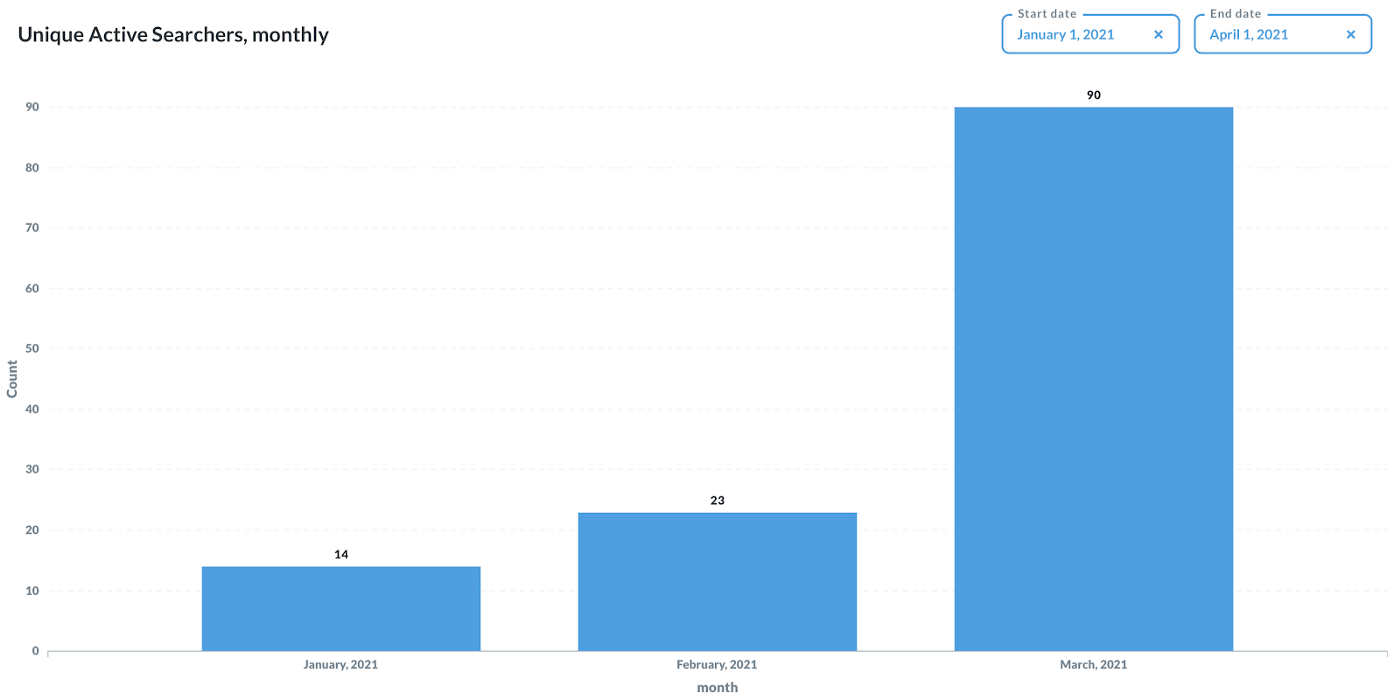

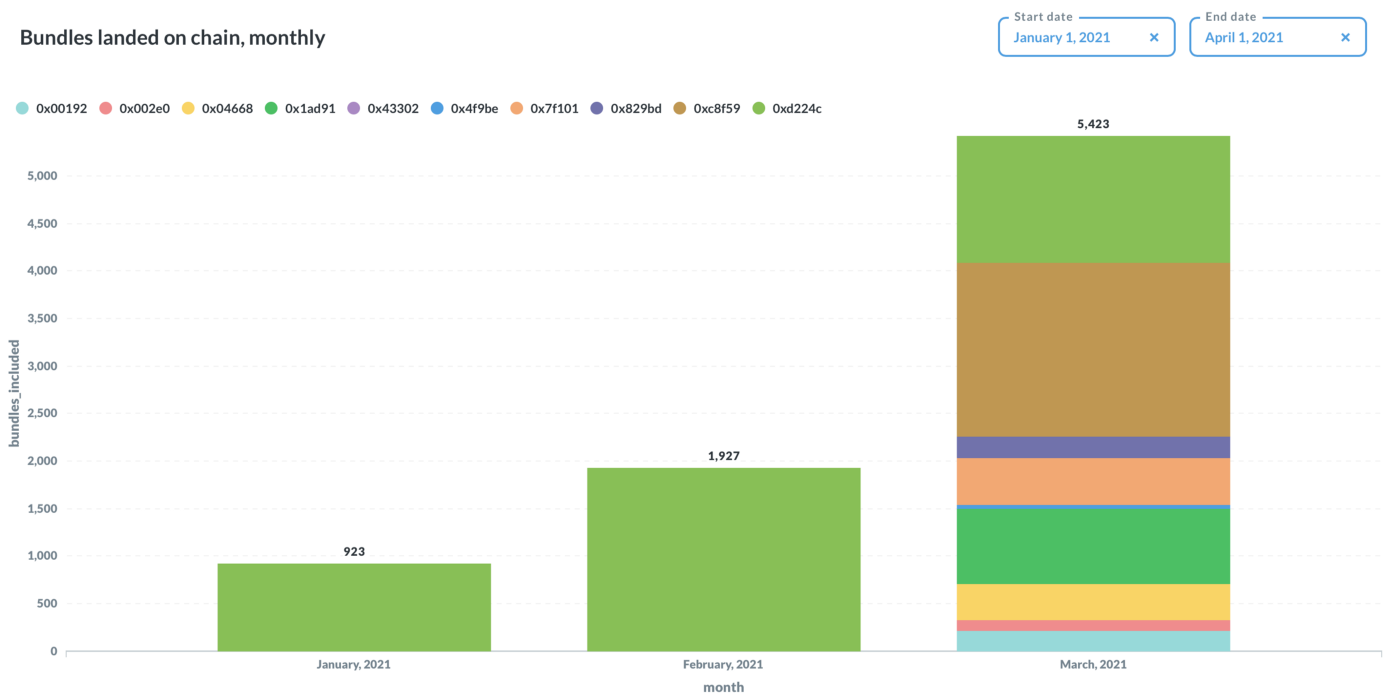

There were 90 unique active MEV searchers that succeeded in landing 5,423 flashbots bundles on-chain, up from 23 searchers in the month of February. Miners on average received 0.2 ETH per “flashblock” (block with flashbots bundle inclusion) of additional revenue, up 313% month-on-month, with the most profitable bundle paying 101.11 ETH as tx bundle tip to a lucky miner.

Source: Etherscan, Flashbots, updated as of UTC 09:25, Apr 12, 2021

As an open research organization, we stay true to our commitment to learning from the community and iterating in public. Here are the highlights:

MEV-geth v1.10.1-mev3 patch release (Mar 31) to resolve the issue around one block re-orgs which may increase uncle rate

Blocks.flashbots.net api update (Apr 2) to change numeric ETH fields to strings to preserve precision (h/t to @satofishi)

Etherscan flashbots labels released as a joint effort to providing transparency in activities on Flashbots network for the community

Flashbots Core v0.2 draft proposal on our upcoming major release, with a structured upgrade process, split into a 2-part release

a) v0.2 pre-release (today, Apr 12): MEV-geth v1.10.2-mev0.2-pre1

An updated bundle pricing formula mitigates a race condition where a searcher successfully mines “2 gwei” bundles, and removes the ability for searchers to inflate the value of their bundle by including transactions from the mempool.

Discarding bundles with reverting txs helps provide improved bundle atomicity guarantees to searchers, thereby reducing their execution risk.

b) v0.2 release (end of April): Request for Comments

Bundle merging

Implement a proxy payment contract

Full block submissions on MEV-geth

Replace HTTP endpoints with a WebSocket connection

Flashbots Fair Market Principles (FFMP)

Searcher Adoption#

Key Metrics#

Source: Etherscan, date range: Jan 6-Apr 5, updated as of UTC 09:00, Apr 12, 2021

The total number of ethereum blocks including flashbots transaction bundles grew 16x from 0.83% at the beginning of March to 13.9% of the entire network by April 1, and the growth has been further accelerating since then.

Source: Flashbots, based on signing address with >20 transactions and API keys. date range: Jan 1-Apr 1, updated as of UTC 09:00, Apr 12, 2021

We witnessed a continued organic searcher growth with 154 unique active searchers who submitted transaction bundles to MEV-relay in March, among which 90 searchers succeeded in landing on-chain. Each day we saw (at least) one new searcher successfully landing a flashbots bundle on-chain.

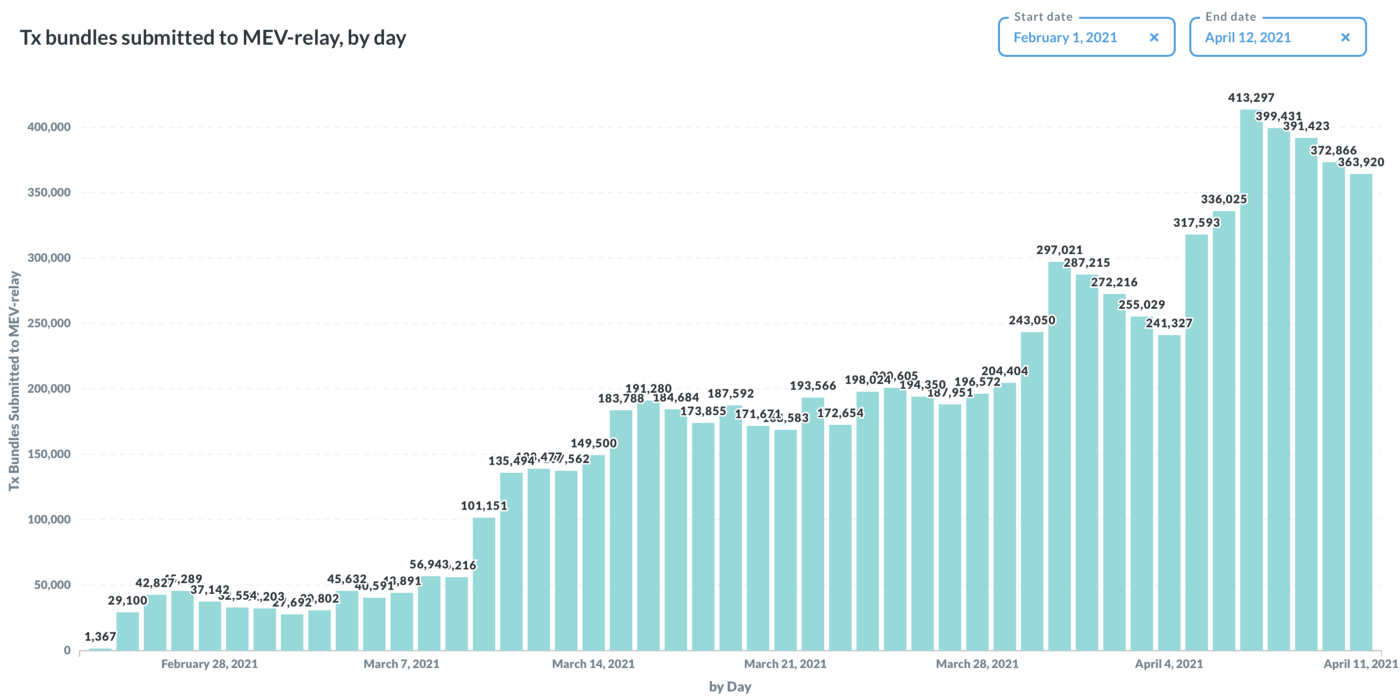

Source: Flashbots, date range: Feb-Apr, updated as of UTC 09:00, Apr 12, 2021

Source: Flashbots, date range: Feb-Apr, updated as of UTC 09:00, Apr 12, 2021

In March, flashbots searchers submitted over 4 million flashbots bundles to our MEV-relay (up 666% from February), among which 5,423 outcompeted transactions in vanilla blocks, and got mined by 8 different mining pools.

Bot migration and reduction in negative network externality#

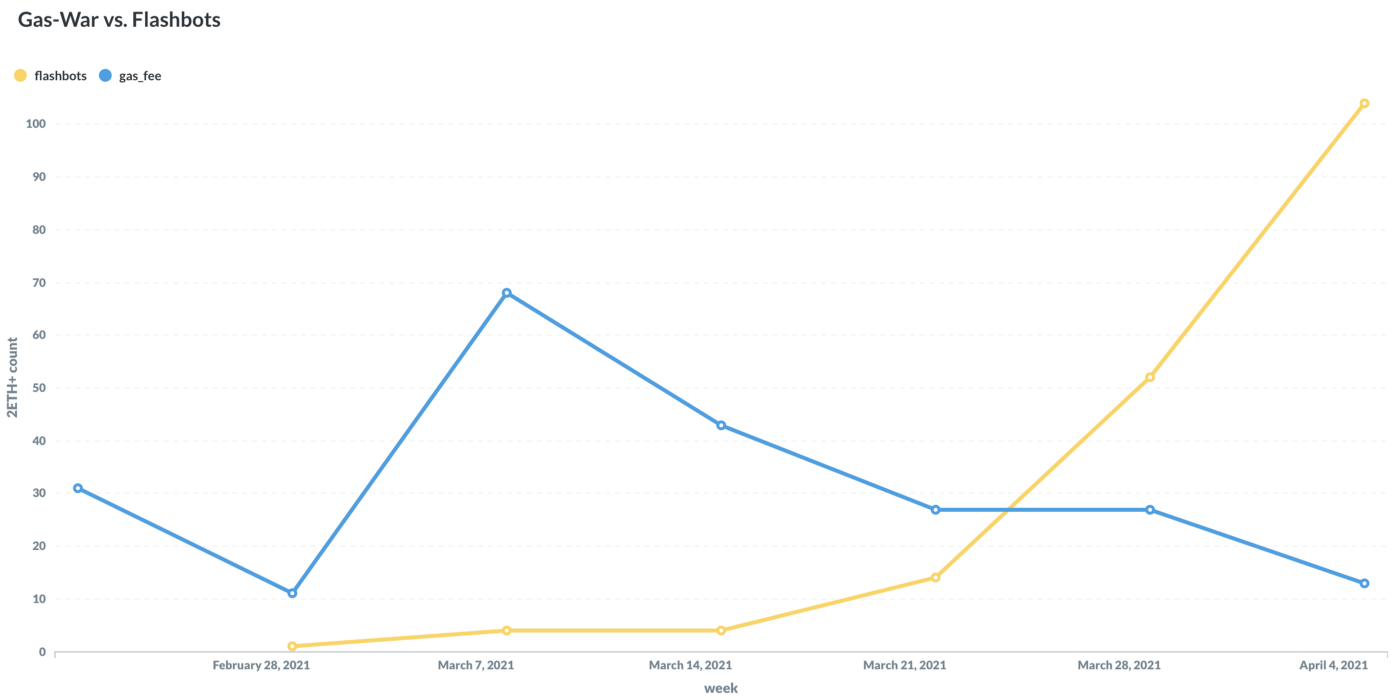

Whether the recent drop in ethereum gas prices has to do with flashbots has been widely discussed on Twitter recently. As noted by MEV Fellow researcher Surya Bakshi in his MEV Roast presentation: MEV Auction Design, the current mempool auction game is an all-pay auction in the open, in which bidders needs to pay regardless of success or failure, and where all bids with associated transactions are in the open, making the auction gameable via gas war or spamming the ethereum network.

On the other hand, the current implementation of flashbots alpha is a sealed-bid auction. By submitting through flashbots MEV-relay, MEV searchers not only preserve pre-trade privacy, but more importantly save on gas paid on failed transactions in the PGA game, only paying tips to miners if their transaction succeeds in landing on-chain.

Source: Flashbots, Etherscan, comparing trend over time of 2+ ETH miner tips txs with number of 2+ ETH gas fee txs. Date range: Jan 1-Apr 1, updated as of UTC 09:00, Apr 12, 2021

We saw a drop in high-gwei transactions in the mempool PGA game responsible for ethereum network congestion and high gas fees, and a rise in high bundle tip transactions on flashbots. We observe MEV searchers shutting down their bots competing in the mempool and focus exclusively on flashbots as hashrate growth on flashbots continues to increase, effectively rendering PGA bots uncompetitive.

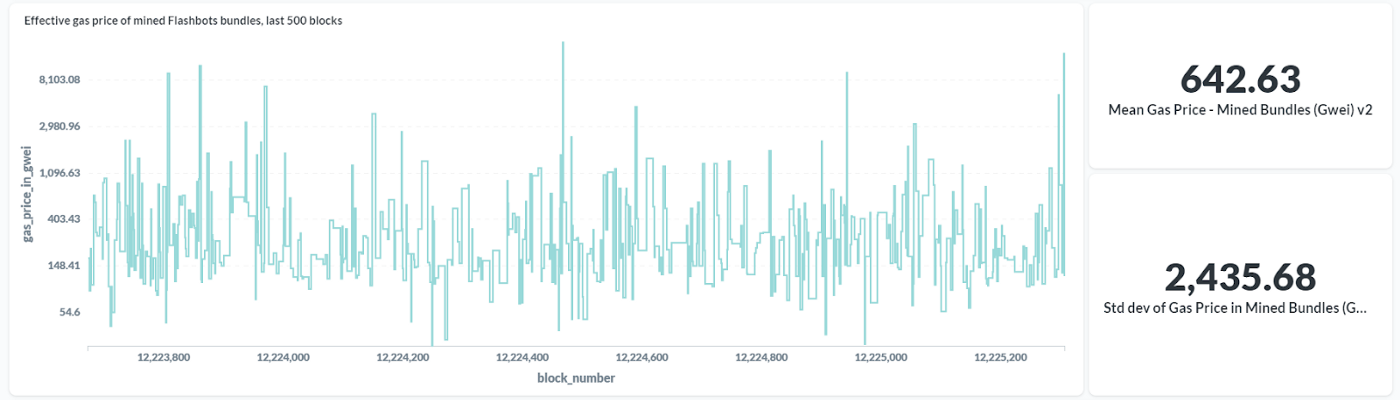

Source: Flashbots, Etherscan, effective gas price calculated by taking the miner tips of flashbots bundles divided by the gas used. Data range: last 500 blocks, updated as of UTC 12:45, Apr 12, 2021

This pattern marks the beginning of a market-driven separation of the “high-speed” and “low-speed” transaction highways, as noted in the recent blog post Ethereum Blockspace: Who Gets What and Why by researchers Leo Zhang and Georgios Konstantopoulos. We are on track to achieving the flashbots mission of mitigating the negative network externalities posed by MEV through the creation of a permissionless, transparent, and fair ecosystem for MEV extraction.

Miner Participation#

Key Metrics#

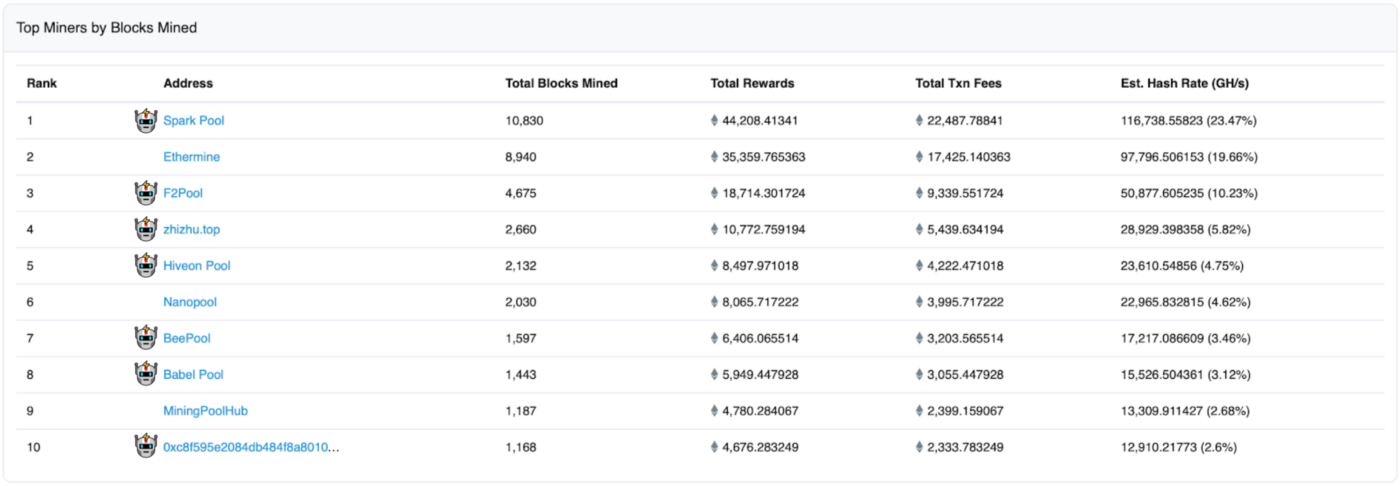

Flashbots hashrate adoption has gone hockey-stick in March as miners turn to MEV as a substitute to their mining income in light of EIP-1559. At the time of writing, 12 mining pools (including 4 out of the top 5) accounting for over 58% of Ethereum hashrate are receiving flashbots transaction bundles.

Source: Flashbots, Etherscan. Date range: hashrate ranking based on 7 day average taking from Apr 1 to Apr 7.

Just a few months ago we thought this was impossible. Mining pool operators who are keepers of the network and hold contractual obligation of uptime to individual miners, are predominantly risk averse. Anecdotally, adopting 3rd party modifications to their core technical infrastructure has rarely ever been done. Moreover, many of them have been approached by traders asking for direct trader collusion bypassing any competition, which at first glance may seem more lucrative, but in reality inefficient in price discovery, suboptimal in economic outcome and creates unfair advantage within the ecosystem.

Since we embarked on the Flashbots journey, we have been blown away by the support and commitment these miners have shown for a fair, democratic, and efficient MEV extraction ecosystem and are thrilled to continue working with them towards a bright MEV future that contributes to the security of ethereum.

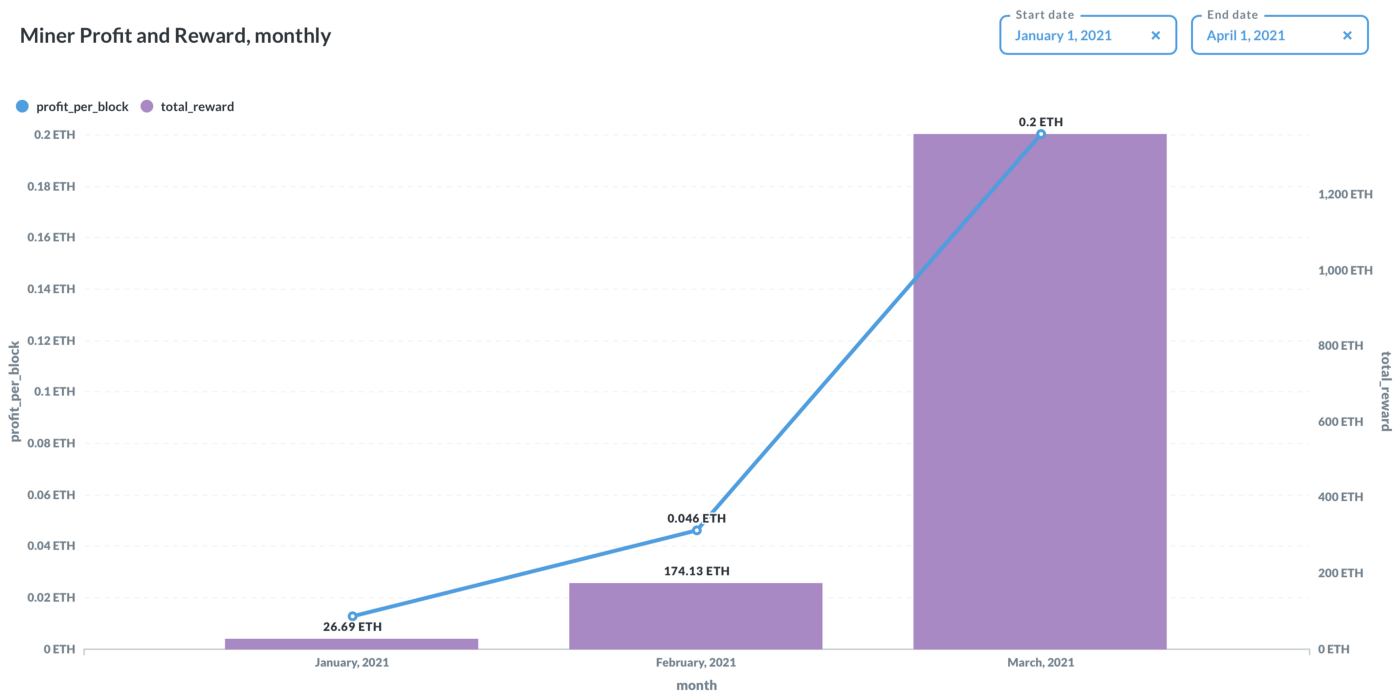

Source: Flashbots, Etherscan. Miner profit is calculated as miner revenue net of opportunity cost (tail gas of the block), reward is the total miner tips per flashbots bundle. Date range: Jan 1 to Apr 1.

Miners’ per block profitability quadrupled in March with an average of 0.2 ETH per block, while the most profitable bundle payed 101.11 ETH as tx bundle tip to a lucky miner. Searchers paid a total of 1.4k ETH in fees to miners for the month of March.

Source: Flashbots, Etherscan. Date range: Jan 1 to Apr 1.

When a miner’s sandwich has gone bad#

The dark forest is a dangerous place, even for the predators. That is why we strive to keep iterating flashbots core infrastructure, the portal of the dark forest, to stay on top of the dynamic game.

In March, an enterprising trader laid a trap for a mining pool’s newly implemented proprietary sandwich bots and walked away with 130 ETH. Read this story to learn about how unsuspecting predators of the mempool can be turned into prey if they are not careful.

There is a reason we designed flashbots system to enable a competitive market for those specializing in the extraction of MEV. The skill sets to identify and safely extract MEV and remain competitive, are very different from those required to run a mining business. By using flashbots, miners can outsource MEV extraction to a market of MEV searchers instead of trying to take on risk in-house. You can think of it as the efficient MEV hypothesis: a permissionless market will always perform better than an individual searcher.

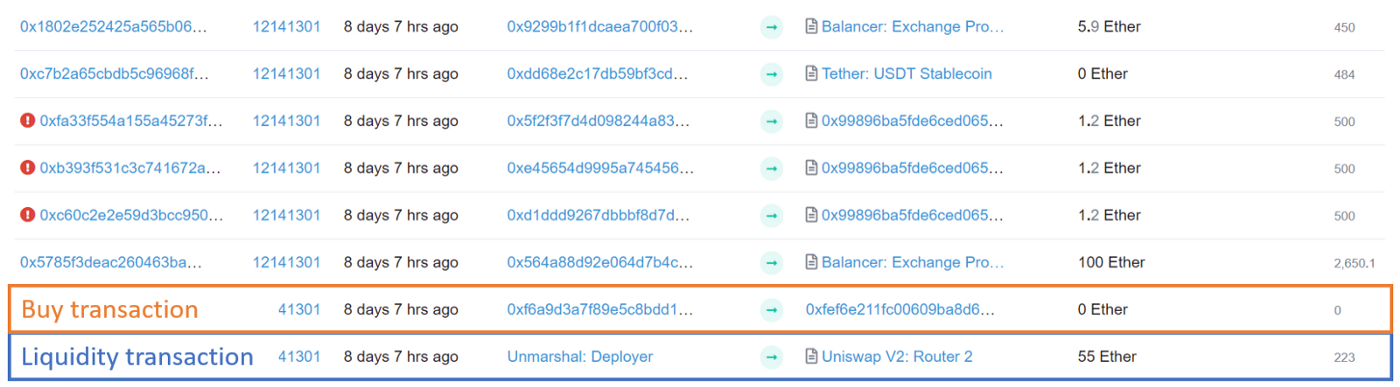

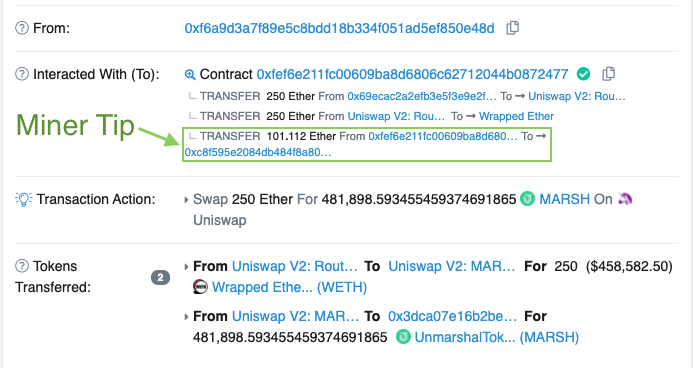

Big bundle alert: 101 ETH in 1 bundle as miner tips#

On March 30th the $MARSH token added significant initial liquidity to Uniswap, and the transaction lingered in the mempool for 4 minutes. That time was long enough for a searcher to find it and combine their own buy transaction.

By doing so this searcher gained the opportunity to buy tokens from the $MARSH pool before anyone else. They chose to purchase 250 ETH worth of $MARSH, and were able to sell this later for a significant profit.

But this did not come cheaply for this searcher: they paid 101.112 ETH or ~$200,000 to a miner to have their buy transaction placed immediately after the liquidity was added. Not a bad payoff in return for ordering two transactions.

Searchers taking on probabilistic MEV in DEX Listing Sniping#

The $MARCH listing sniping is not an isolated event, in March there was a surge in MEV searchers using Flashbots to place the first buy after tokens were listed on Uniswap. That is particularly interesting because the profit opportunities these searchers are interested in isn’t deterministic in the same way as typical MEV strategies such as liquidations or arbitrages are. In this case it is probabilistic MEV with some chance of not paying off at all, but on the other hand potentially yielding much higher profit than arbitrages do if the searcher is willing to take on proprietary risk.

Why flashbots and where next?#

MEV Roast with Vitalik - the blockspace bazaar

- Blockspace market structure on ETH1, L2s and ETH2 (video | slides)

“Blockspace is the commodity that powers the heartbeats of all crypto networks. In PoW, miners are the producers, mining pools are the auctioneers, and users are the bidders.” — Ethereum Blockspace: Who Gets What and Why

Leo Zhang and Georgios Konstantopoulos dived into the supply and demand dynamics of the ethereum blockspace market given its past, present and future roadmap, and why MEV is an inevitable and integral part of the evolution of the blockspace market.

- MEV auction design (video | slides)

Surya Bakshi defined the problems in the current mempool auction, and how MEV auction fits in the family of MEV solutions and mitigations. After identifying the desired properties for an optimal MEV auction, Surya’s auction literature survey points to the direction of a sealed-bid MEV auction.

- MEV-sgx: a true sealed-bid MEV auction design (video | slides)

Robert Miller presented the design for a future flashbots core infrastructure with complete cryptographic guarantee for privacy. MEV-sgx is a solution aiming to provide searchers a way to send their transaction bundles to miners directly without the need for a relay and to keep those bundles private until mined. It is the next step in achieving our design goals listed above, and we will be formally releasing our spec in the coming weeks.

Design goals for flashbots core infrastructure

- Account abstraction via flashbots

A lively discussion between Vitalik Buterin, Phil Daian, Rick Dudley, Ansgar Dietrichs and Mariano Conti exploring various approaches for account abstraction on Ethereum: flashbots & EIP-2938/EIP-3074.

Flashbots research series#

We released the first in our new series of Flashbots research posts, Quantifying Realized Extractable Value. This post establishes a unified framework for the operational quantification of Realized Extractable Value (REV), and will help achieve consistency in the various metrics that capture the MEV phenomenon. Current Flashbots research initiatives can be found in our research repository.

Flashbots Community#

White hat rescues, white hat tooling, and a white hat league!#

Summoning the Flashbots White Hat Magicians: a team of 6 whitehats from the Flashbots community has collectively rescued over $200K of funds at risk using flashbots infrastructure since March

FlashbotsCheckAndSend has been used 72 times since March

Rescue of the month: Community member Alex Manuskin conducted our first white hat league effort, and succeeded in one of the largest Flashbots white-hat rescues to date, against a coordinated scam targeting $CFI holders in the official Telegram group putting $150K of $CFI at risk of being drained once unlock period ended.

Flashbots.tools: a community centric white hat MEV tool on flashbots. @kendrick_tn built the first web app on flashbots, for fun and for good. It’s a simple white hat MEV tool which allows for performing gasless erc20 token rescues in the event of a private key compromise. This app displays the power of using flashbots for account abstraction as a new primitive for ethereum and enables anyone to use flashbots for good.

A flashbots fan demoing a live rescue using flashbots on a Youtube video “Enter the Dark Forest: the terrifying world of MEV and Flash bots” by the Defiant .

Heartwarming dark forest story with plot twists where Good Samaritan generalized front runner bots crushed hackers and returned $3million lost funds.

Open design challenge: Flashbots for frontrunning protection#

An under-utilized feature of flashbots is frontrunning protection. While the flashbots architecture is designed for making MEV extraction as efficient as possible, at its core flashbots provides a private communication channel between ethereum users and miners for transaction ordering preferences. While this is mostly used today by searchers looking to extract MEV, it can also be used by regular users whose transaction order preferences are simply “Don’t allow anyone to get in front of me because I don’t want to be frontrun!”. We hope to see more applications like decentralized exchanges making use of this feature to protect their users from mempool frontrunning.

MEV NFT: Absolution#

Flashbots community member Fiona Kobayashi created and minted a flashbots centered NFT as a part of their MEV Series! Check out “Absolution,” a short story about a wounded bot seeking shelter in the dark forest.

Join us this Thursday (Apr 15) for our monthly Flashbots Community Call (subscribe to MEV calendar), where we will share:

A sneak peek preview of the Flashbots Transparency Dashboard

Explain our latest design consideration for Flashbots v0.2 release

Draft for Flashbots Fair Market Standards

How the proposed changes may impact your bots or your mining pool

Any thing else on your mind!

About Flashbots#

Flashbots is a research and development organization formed to mitigate the negative externalities and existential risks posed by miner-extractable value (MEV) to smart-contract blockchains, starting with ethereum.

We are not your typical startup, we are fully remote and our principles are based on that of a pirate hacker collective. We are actively recruiting talented, self-directed individuals to join our crew. You can find out more about us and our open positions on our github.